What to know about Earned Income Tax Credit

What to know about Earned Income Tax Credit

Who is eligible to claim the EITC?

Workers may use the EITC Assistant, an online tool, to check their eligibility, which may be affected by changes in marital, parental or financial status. Workers also may visit the Child-related Tax Benefits Comparison page to learn more about basic eligibility rules for the EITC and several other tax credits.

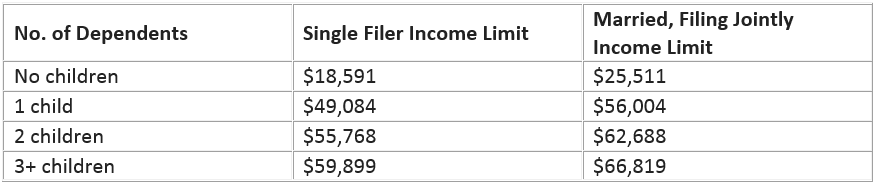

EITC is for workers whose income did not exceed the following limits in 2024:

*Investment income limit: $11,600

Workers also must:

- Be a U.S. citizen or resident alien all year.

- File a tax return even if their income level doesn’t usually require them to file.

- Have a valid Social Security number (SSN) for themselves, as well as for their spouse, if filing a joint return, and for each qualifying dependent claimed for the EITC.

- File a return without Form 2555, Foreign Earned Income.

There are special rules for military personnel, clergy and ministers and taxpayers with certain types of disability income or a child who is disabled.

Eligible workers between the ages of 25 and 64 who have no dependents may receive up to $632 by claiming the EITC, while married but separated spouses who do not file a joint return may qualify for the EITC if they meet certain requirements.

Those with qualifying children can receive a maximum of $7,830 when claiming the EITC for tax year 2024, up from $7,430 in tax year 2023.